30 year Loan Term!

Purchase, Rate & Term, Cash-Out

Low Documentation

"Common sense" underwriting

Close in 3 weeks or less

The Portfolio Mortgage Loan Program is our most sought after lending program for real estate investors. Why? Simply put, this unique mortgage program is specifically tailored for real estate investors who own residential rental properties and want to secure a 30 year term without having to provide all of the documentation of a traditional bank, or lenders who must abide by Fannie Mae or Freddie Mac underwriting guidelines. This loan bypasses most of the red tape other lenders set forth and saves a ton of time (and a few headaches) since there are no hoops to jump through.

FundingPilot is proud to offer some of the most diverse, competitive, and flexible residential mortgage loan programs. The Portfolio Fixed-Rate Mortgage Loan is the best option for real estate investors looking for a dependable long term mortgage which creates stability when it comes to earning a return on your investment property. To receive your custom, hassle-free loan quote please complete the "QUICK QUOTE" Form or call us directly at 888-860-2844.

Everything you need to know about the Portfolio Fixed-Rate Mortgage Loan Program:

Loan Amounts: $100,000 - $5,000,000

Interest Rates: 8.75%+

Amortization: 30 years

Fixed Term: 30 years

Payment: Principal & Interest

Frequency: Monthly

Loan-to-Value (LTV): ≤ 75%

Credit Score: 650+ FICO

Occupancy: Non-Owner Occupied

Property: Residential

Property Types: SFR, 2-4 Units, Condo

Use of Funds: Business or Investment purposes ONLY

Lending Territory: Alabama, Arkansas, Colorado, Connecticut, Delaware, Washington D.C., Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming

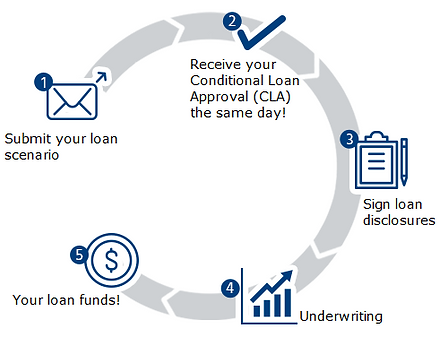

APPROVAL PROCESS: Portfolio Fixed-Rate Mortgage

The approval process for the residential Portfolio Fixed-Rate Mortgage Loan is designed to bypass many of the common obstacles associated with full-documentation mortgage loan programs. Once your dedicated Loan Officer reviews your scenario and confirms your eligibility a Pre-Approval will be issued along with a short list of basic underwriting documents. Once received your application is submitted to underwriting for a final approval.

Underwriting will then outline any conditions of approval and list any documents which are needed prior to issuing a clear-to-close. Once your conditions have been cleared a closing date and time will be scheduled.

To prevent delays, your appraisal and title search will be ordered once we receive your signed disclosures. The entire funding process for a Portfolio Fixed-Rate Mortgage Loan takes roughly 3 weeks from start to finish.

ADDITIONAL LENDING PROGRAMS

We're the best at what we do for a reason...

FLEXIBILITY. No more needing to go from bank to bank trying to find small business loans, we cover it all. Whether your credit is strong or poor we have business lending programs to meet your capital needs.

FOCUS. We're 100% focused on small business owners like yourself. We deliver results nationwide and have funding specialists available 6 days per week.

SPEED. We save you lots of time when looking for a small business loan. You answer a few questions and we show you your options. We make getting a small business loan simple and fast.

TRUST. We take care of you every step of the way. Our business lending advisors believe in your business and care about your success. It’s an experience you’ll tell your friends about, guaranteed! Did we mention our A+ rating with the Better Business Bureau?

$794,000 FUNDED!

When a manufacturing company in Pennsylvania needed to meet a large purchase order request they needed funding quickly to meet their demand. Within a matter of 5 business days they were funded and are continuing to leverage our business lending programs to further grow their successful business.

LOAN TYPE: Asset-Based Loan

$28,600 FUNDED!

When a local bakery / cafe was in need of some working capital FundingPilot was able to step in and get their business $28,600 in under 48 hours!

LOAN TYPE: Merchant Cash Advance

$225,000 FUNDED!

Mark & Samantha needed to renovate their location but couldn't qualify for a commercial renovation loan, nor most business loans due to credit score blemishes. By using an investment property they owned as collateral we were able to fund them $225,000 in 9 days.

LOAN TYPE: Secured Business Loan

FundingPilot is making waves! Just a few places you'll find us: